Focusing on strengthening the places we’re proud to serve

Citizens Trust Bank is a proud Community Development Financial Institution [CDFI].

Community Development Financial Institutions (CDFIs) Share A Common Goal Of Expanding Economic Opportunity In Low-Income Communities By Providing Access To Financial Products And Services For Local Residents And Businesses. In accordance with federal laws and U.S. Department of the Treasury policy, this organization is prohibited from discriminating based on race, color, national origin, sex, age, or disability. LEARN MORE HERE

We are committed and continue to promote community economic growth and stability. We believe that taking care of our customers and the community through personalized engagement: we create a win for everyone. Our conscious contributions will continue to enhance our performance

and enable our ability to remain a valued partner.

Impact Report

Community Involvement

We are deeply committed to promoting community economic growth and stability. Through community involvement, we prioritize personalized engagement with both our customers and the community, ensuring mutual benefits and creating a win for everyone. Our efforts and conscious contributions not only enhance our performance but also strengthen our role as a valued partner in fostering a thriving, resilient community.

In The News

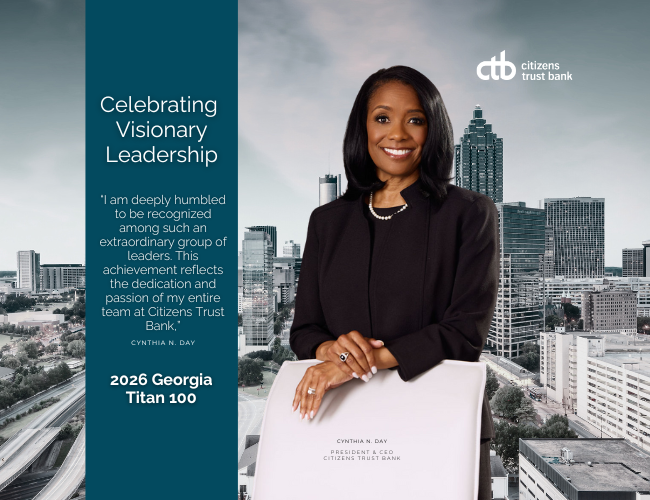

February 10, 2026

January 9, 2026

November 26, 2025

May 23, 2025

February 5, 2025

January 31, 2025

January 31, 2025

January 31, 2025

November 14, 2024

October 30, 2024

May 17, 2024

March 30, 2024

June 22, 2023

March 1, 2023

The Impact of Partnership:

Citizens Trust Bank is proud to partner with Federal Home Loan Bank of Atlanta to make homeownership more accessible.

2026 Homeownership Program funding limits are as follows:

- First come first served

- Down Payment Assistance up to $20,000

Bank star ratings, based on 12/31/2024 financial data, are meticulously analyzed by Bauer Financial because peace of mind matters.

Citizens Trust Bank YouTube Learning Channel

The Citizens Trust Bank YouTube Learning Channel is your go-to resource for financial empowerment. Discover educational videos on the bank’s founding mission, budgeting, money management, and homeownership, along with insights into our innovative products and services.

Whether you’re growing your business, planning your financial future, or exploring banking solutions, our channel provides tips and tools to help you achieve economic success.

Subscribe today and join us. Start your journey toward financial wellness!

Citizens Trust Bank partners with organizations that share our drive to close the wealth gap and uplift more of our communities’ citizens. Together, we scale impact—leveraging technology, resources, and expertise to reach more consumers and businesses. These partnerships fuel our mission to strengthen community ecosystems and create lasting economic opportunity for underserved / disinvested communities.

Let's stay connected

Follow Citizens Trust Bank on social media and join a community that’s passionate about building wealth, expanding opportunity, and driving change.

Your voice matters—and together, we’re making a difference.